Hosted by the Department of

Economics, University of Peloponnese

Please read the Disclaimer

EurOil Index, Trading-by-Rotation

and TbR logos © 2007/2008 Dimitrios D. Thomakos

|

Historical Performance, Friday data |

An exercise in Trading by Rotation S&P500 &

VIX |

Historical Performance, Monday data |

|

Created and maintained by Dimitrios D. Thomakos, © 2008 |

||

|

Last updated: Trading updates available after Mon & Fri |

|

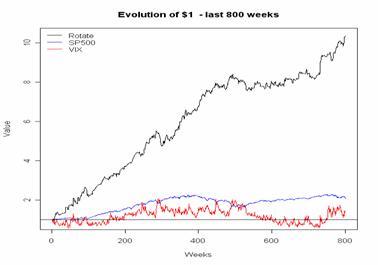

Figure on left updated on |

cumulative value of $1 over past

800 weeks, rolling window, rotation strategy, Friday data |

|

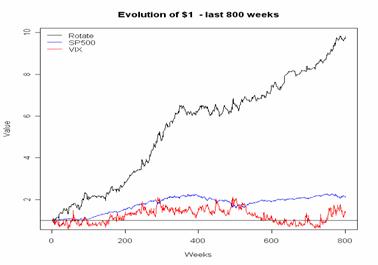

Figure on right updated on |

cumulative value of $1 over past 800 weeks, rolling window,

rotation strategy, Monday data |

In case the webpage is not promptly updated due to server

problems please check its mirror page at http://metronfinance.awardspace.com/rotation_sp500.html

|

Real Time TbR Strategy Performance (as cumulative value

of $1) |

From |

1.3291 |

|

From |

1.7565 |

|

|

Real Time Performance of S&P500 and the VIX (as cumulative value of $1) |

S&P500 |

0.9282 (Monday), 1.0218 (Friday) |

|

VIX |

0.9888 (Monday), 0.8619 (Friday) |

|

|

Sign Success Ratio (as %) |

Monday model: |

60.87% |

|

Friday model: |

65.22% |

|

|

Current recommendation (using data from

previous week) |

For |

S&P500 (1) |

|

For |

S&P500 (2) |

(1) Uniform recommendation across evaluation periods

(2)

Uniform recommendation across evaluation periods

|

|

Friday model |

Monday model |

||||

|

Real

Time Summary

Statistics |

TbR |

S&P500 |

VIX |

TbR |

S&P500 |

VIX |

|

Weekly average

return (as %) |

3.29 |

0.09 |

-0.60 |

1.43 |

-0.31 |

-0.05 |

|

Weekly std. deviation (as %) |

8.71 |

2.75 |

12.43 |

5.74 |

3.15 |

12.27 |

|

Weekly Sharpe ratio |

0.38 |

0.03 |

-0.05 |

0.25 |

-0.10 |

0.00 |

|

Maximum realized gain (as %) |

17.14 |

4.75 |

17.14 |

14.37 |

5.58 |

30.32 |

|

Maximum realized loss (as %) |

-13.56 |

-4.70 |

-18.12 |

-7.76 |

-7.76 |

-22.55 |

Visit another

Trading-by-Rotation webpage: Predictions

and TbR for Oil and the Euro

Visit my

blog: http://predict-and-trade.blogspot.com/

Click below to link on

this webpage:

Latest News, Summary of Trading Recommendations,

Introduction, Data, Methodology, Simulated Trading and Performance

![]() Summary of Trading Recommendations

Summary of Trading Recommendations

Based on data of the previous week

Recommended asset,

Monday data, for

Recommended asset,

Friday data, for

Welcome to the TbR S&P500 and VIX webpage! I continue,

with another class of assets, the research effort on rotation-based trading

strategies that I implemented and maintain in the EurOil

Index

and the TbR webpages. Here I use

the S&P500 equity index and the VIX index of its implied volatility. Very

illuminating discussions with Dr. Achilleas Venetoulias (who I would like to

thank without implicating) and Dr. Yianos Kontopoulos, the existing literature

and pure curiosity lead me to experiment with rotation between an asset and its

underlying volatility and, it turns out, the strategy works quite well! See

more in the discussion on performance below.

I am using data from publicly available, internet-based

sources. Weekly (Monday and Friday) data for both the S&P500 and VIX are

available online from Yahoo!

Finance. The data start on January 1990 (VIX availability).

The trading

methodology I am using here is based on some of my past research. I use a

modification of the methods presented in the paper “Market Timing and Cap Rotation”, by D. Thomakos, T. Wang and

J. Wu, Mathematical and Computer Modeling

(2007), vol. 46, pp. 278-291 (available on http://www.sciencedirect.com),

to construct a trading strategy that rotates between the two assets based on their

predicted signs. The methodology can be seen as a generalized ‘sign

forecasting’ approach although it is probably more informative than simple

pairwise sign forecasting. The strategy gives long-only signals and does not

take into account transactions costs so the results presented should be

interpreted accordingly.

A

rotation-based strategy will heavily depend on the choice of assets used in the

rotation. For example, the weekly drawdown will always equal the minimum return

among the two assets, if that particular asset is (wrongly) selected. Therefore

the strategy’s success depends on whether it can correctly predict the relative

sign of the assets most of the time and note that we do not need to be

completely accurate all the time.

This is illustrated in the historical evaluation that I present in the next

section.

![]() Simulated Trading and Performance

Simulated Trading and Performance

Cumulative returns

|

Trading recommendation for Monday (based on data a week

before) |

Asset |

Realized Return % S&P500 |

Realized Return % VIX |

Sign Success Ratio |

Cumulative Sign Success Ratio (in %) |

Cumulative Value of $1 |

|

|

S&P500 |

-7.76 |

30.32 |

- |

0.00 |

0.9223 |

|

|

S&P500 |

3.26 |

-11.00 |

+ |

50.00 |

0.9549 |

|

|

VIX |

1.96 |

-6.66 |

- |

33.33 |

0.8883 |

|

|

VIX |

-3.06 |

6.01 |

+ |

50.00 |

0.9484 |

|

|

S&P500 |

0.72 |

-7.56 |

+ |

60.00 |

0.9556 |

|

|

S&P500 |

1.69 |

-10.54 |

+ |

66.66 |

0.9725 |

|

|

VIX |

-2.99 |

13.20 |

+ |

71.43 |

1.1045 |

|

|

S&P500 |

-4.45 |

11.15 |

- |

62.50 |

1.0599 |

|

|

S&P500 |

0.25 |

9.29 |

- |

55.55 |

1.0624 |

|

|

S&P500 |

5.58 |

-22.55 |

+ |

60.00 |

1.1182 |

|

|

VIX |

-2.03 |

-0.47 |

+ |

63.63 |

1.1135 |

|

|

S&P500 |

3.70 |

-13.30 |

+ |

66.66 |

1.1505 |

|

|

VIX |

-3.27 |

6.06 |

+ |

69.23 |

1.2111 |

|

|

S&P500 |

4.41 |

-15.01 |

+ |

71.43 |

1.2552 |

|

|

VIX |

0.59 |

-4.28 |

- |

66.66 |

1.2123 |

|

|

VIX |

0.79 |

-3.84 |

- |

62.50 |

1.1739 |

|

|

S&P500 |

-0.28 |

-6.05 |

+ |

64.71 |

1.1711 |

|

|

VIX |

1.63 |

-4.48 |

- |

61.11 |

1.1262 |

|

|

VIX |

-2.93 |

14.37 |

+ |

63.16 |

1.2699 |

|

|

S&P500 |

0.02 |

0.96 |

- |

60.00 |

1.2701 |

|

06/09/2008 |

S&P500 |

-1.74 |

15.35 |

- |

57.14 |

1.2527 |

|

06/16/2008 |

S&P500 |

-0.12 |

-9.85 |

+ |

59.09 |

1.2515 |

|

06/23/2008 |

VIX |

-3.15 |

7.76 |

+ |

60.87 |

1.3291 |

|

|

S&P500 |

|

|

|

|

|

[1.] The realized return for each asset is

the weekly return (from Monday to Monday) from the week before to the week of

the trade – return measured as difference in log prices.

*Data for Tuesday the 27th –

the markets were closed on the 26th.

|

Trading recommendation for Friday (based on data a week

before) |

Asset |

Realized Return % S&P500 |

Realized Return % VIX |

Sign Success Ratio |

Cumulative Sign Success Ratio (in %) |

Cumulative Value of $1 |

|

|

VIX |

0.4081 |

6.76 |

+ |

100.00 |

1.0676 |

|

|

S&P500 |

4.75 |

-18.12 |

+ |

100.00 |

1.1151 |

|

|

VIX |

-4.70 |

15.19 |

+ |

100.00 |

1.2670 |

|

|

S&P500 |

1.39 |

-11.11 |

+ |

100.00 |

1.2809 |

|

VIX |

0.23 |

-3.91 |

- |

80.00 |

1.2418 |

|

|

|

VIX |

-1.67 |

9.81 |

+ |

83.33 |

1.3399 |

|

|

S&P500 |

-2.84 |

3.51 |

- |

71.43 |

1.3115 |

|

|

S&P500 |

-0.40 |

12.53 |

- |

62.50 |

1.3075 |

|

|

S&P500 |

3.16 |

-15.75 |

+ |

66.66 |

1.3391 |

|

|

VIX |

-1.08 |

-3.48 |

- |

60.00 |

1.3043 |

|

|

VIX |

4.11 |

-13.56 |

- |

54.54 |

1.1687 |

|

|

VIX |

-2.78 |

4.40 |

+ |

58.33 |

1.2127 |

|

|

S&P500 |

4.22 |

-15.31 |

+ |

61.54 |

1.2549 |

|

|

VIX |

0.54 |

-2.72 |

- |

57.14 |

1.2277 |

|

|

VIX |

1.14 |

-7.47 |

- |

53.33 |

1.1530 |

|

|

VIX |

-1.83 |

6.55 |

+ |

56.25 |

1.2185 |

|

|

S&P500 |

2.63 |

-16.42 |

+ |

58.82 |

1.2448 |

|

05/23/2008 |

VIX |

-3.53 |

17.14 |

+ |

61.11 |

1.4162 |

|

|

S&P500 |

1.76 |

-9.21 |

+ |

63.15 |

1.4338 |

|

06/06/2008 |

VIX |

2.87 |

27.87 |

+ |

65.00 |

1.7125 |

|

06/13/2008 |

S&P500 |

-0.05 |

-10.46 |

+ |

66.66 |

1.7120 |

|

06/20/2008 |

VIX |

-3.14 |

7.49 |

+ |

68.18 |

1.7870 |

|

|

S&P500 |

-3.05 |

2.46 |

- |

65.22 |

1.7565 |

|

|

S&P500 |

|

|

|

|

|

[1.] The realized return for each asset is the weekly return

(from Friday to Friday) from the week before to the week of the trade – return

measured as difference in log prices.

* Click on the link to see what happened intraday on the 22nd and

how the prediction went off by a last minute announcement

** Data for Thursday the 20th – the markets was

closed on the 21st.

Discussion

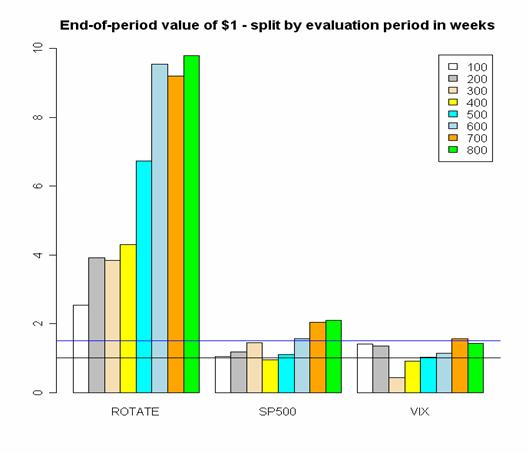

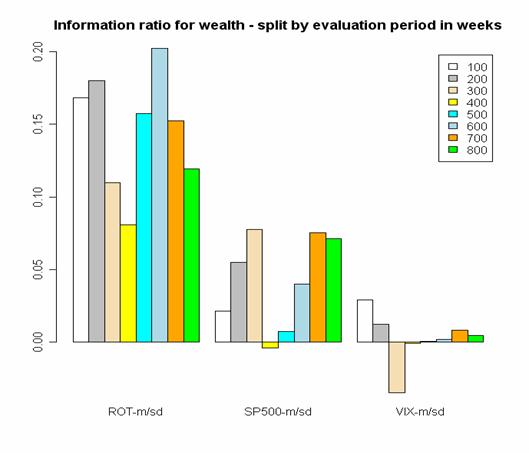

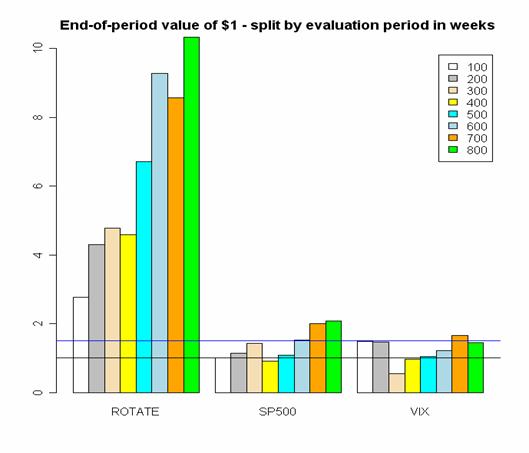

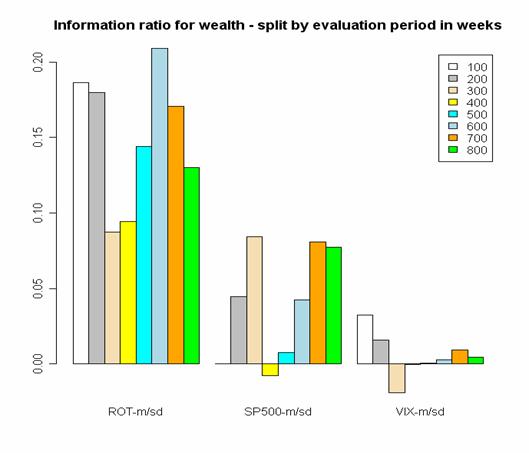

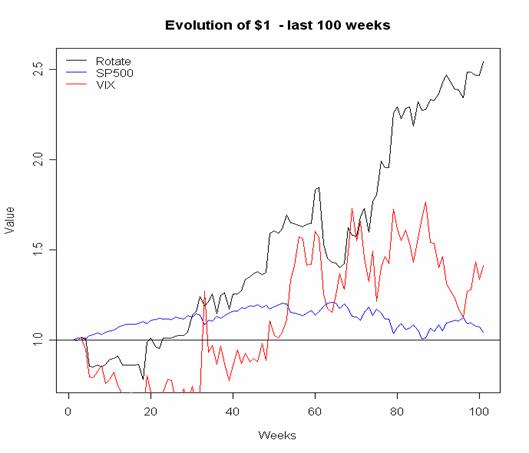

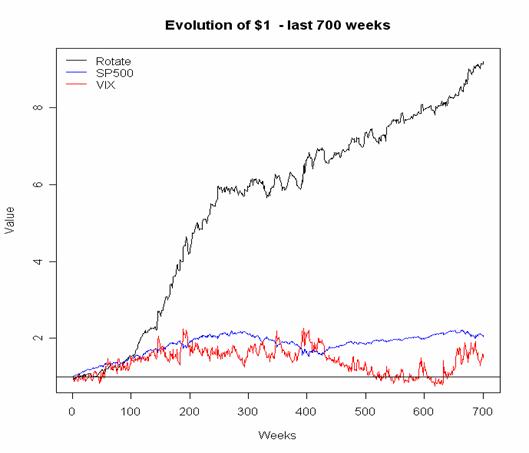

The

figures below summarize the trading performance of the proposed rotation-based

strategy vs. the performance of the S&P500 index and VIX. I present the

accumulated value of $1 invested at the beginning of different evaluation

periods and the corresponding information.

The strategy clearly outperforms both indices for all evaluation

horizons. The performance of the strategy is similar to the performance of the

same rotation strategy in the EurOil Index project, only that here we have

more data for evaluation and the cumulative values are much higher.

To

gauge the frequency of correct (and incorrect) decision-making of the strategy

I calculated the average number of times that the strategy picked the asset

with the highest (lowest) return. Surprisingly, these averages did not change

drastically with the length of the evaluation period, something that can be

considered a sort of ‘robustness’ property of the strategy. The average number

of correct decisions was about 56% (ranging from 53% to 58.5%). These numbers

are higher than the corresponding ones in Oil and Euro trading and can possibly

be attributed to the use of volatility in performing the rotation.

Figure 1 – Monday data (updated

Figure 2 – Friday data (updated

Figure 3 – Monday data (updated

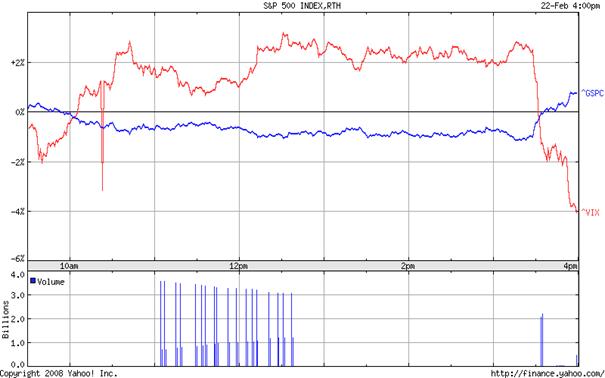

Figure 4 – Intraday evolution of

S&P500 (^GSPC, blue line) and VIX (^VIX, red line) on

Disclaimer: The contents of this

webpage are provided for information purposes only. Prices shown in this

webpage are indicative and the author is not offering to buy or sell or

soliciting offers to buy or sell any financial instrument. The views in this

publication are those of the author alone and are subject to change at any

time, and he has no obligation to update the opinions or the information in

this webpage. The author of this webpage does not accept any liability

whatsoever for any direct or consequential loss arising from any use of the

information provided. The information in this webpage is not intended to

predict actual results, which may differ substantially from those presented.

The author is not affiliated with any of the companies used in the analysis

that is presented in this webpage.