Hosted

by the Department of Economics, University of Peloponnese

Please

read the Disclaimer

EurOil Index, Trading-by-Rotation

and TbR logos © 2007/2008 Dimitrios D. Thomakos

|

|

EurOil Index Trends, Forecasts and Simulated Trading for Oil and the Euro |

|

|

|

|

Created and maintained by Dimitrios D. Thomakos © 2007/2008 Last updated: |

|

|

|

|

Forecast

and Trading updates available after Wed each week Other

content updates as indicated |

|

Figure

on right updated on:

Visit

another Trading-by-Rotation website: TbR with S&P500 and

VIX

IMPORTANT: after 6 months of real

time evaluation I will not be updating the whole page but only the trading

recommendations of the models. For all the information, including methodology,

references, figures and performance of the past 6 months please link to the

saved webpage here!

In case the webpage is not promptly updated due to

server problems please check its mirror page at http://metronfinance.awardspace.com/EurOil_Index.html

![]() Summary

of Trend Forecasts and Trading Recommendations (scroll down for more,

including graphs with the strategies information ratios)

Summary

of Trend Forecasts and Trading Recommendations (scroll down for more,

including graphs with the strategies information ratios)

The historical

summary below until

|

Historical

Evaluation until |

Recommendation for

|

||

|

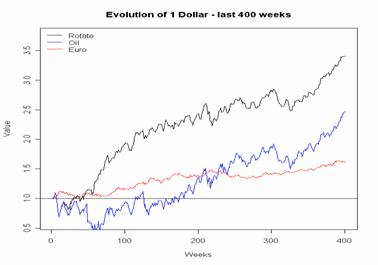

Cumulative

Returns |

Rotation #1 – no cash (31 weeks) |

38.66% |

Euro |

|

Rotation #2 – optimal

with cash (31 weeks) |

29.99% |

Euro |

|

|

Rotation #3 – no cash,

re-optimized model (21

weeks) |

9.58% |

Euro |

|

|

GMV portfolio* (31 weeks) |

7.00% |

|

|

|

Oil (31 weeks) |

38.47% |

||

|

Euro (31 weeks) |

5.50% |

||

|

|

|||

|

Sign

Success Ratio |

Rotation #1 – no cash (30 weeks) |

58.06% |

|

|

Weeks

in Cash |

Rotation #2 – optimal

with cash (30 weeks) |

6 |

|

*GMV

== Global Minimum Variance

#Switch

from #2 cash strategy to #1 cash strategy

Real

Time Statistics of the TbR strategy and comparison with Oil and Euro

|

Summary Statistics |

Oil |

Euro |

No-cash rotation |

GMV portfolio |

|

Average weekly return (%) |

1.24 |

0.18 |

1.25 |

0.23 |

|

Weekly std. deviation (%) |

3.02 |

1.45 |

2.35 |

1.44 |

|

Weekly Sharpe ratio |

0.41 |

0.12 |

0.53 |

0.16 |

|

Minimum realized return (%) |

-7.70 |

-2.38 |

-5.06 |

-2.43 |

|

Maximum realized return (%) |

6.05 |

2.63 |

6.05 |

2.58 |

Trend Forecast Summary for the week of

[1.] Oil. A short-term sharp trend reversal

to within the standard error bounds is anticipated. The width of the standard error

band has been decreasing over the past weeks, a potential indicator that the

sharp rise of Oil prices is nearing an end.

[2.] Euro. The level of the series has

reached the lower bound of the trend prediction bands. The short-term trend

outlook now includes a further Euro depreciation before a reversal to within

the standard error bounds.

Disclaimer:

The

contents of this webpage are provided for information purposes only. Prices shown

in this webpage are indicative and the author is not offering to buy or sell or

soliciting offers to buy or sell any financial instrument. The views in this

publication are those of the author alone and are subject to change at any

time, and he has no obligation to update the opinions or the information in

this webpage. The author of this webpage does not accept any liability

whatsoever for any direct or consequential loss arising from any use of the

information provided. The information in this webpage is not intended to

predict actual results, which may differ substantially from those presented.